In today's complex healthcare landscape, finding ways to manage costs while also building financial security can feel like a daunting task. You've likely heard whispers about Health Savings Accounts (HSAs) and wondered: Is an HSA worth it for me? The short answer for many is a resounding yes, especially when viewed through the lens of long-term financial planning. This powerful tool isn't just about covering immediate medical bills; it's a strategic vehicle for both healthcare savings and retirement planning, offering a unique blend of tax advantages that can significantly boost your financial future.

Unlocking the Power of an HSA: More Than Just a Savings Account

An HSA stands apart from typical savings accounts because it��s specifically designed to work in tandem with a High-Deductible Health Plan (HDHP). Think of your HDHP as your primary health insurance, offering lower monthly premiums, while your HSA acts as a personal bank for your medical expenses. To be eligible for an HSA, you generally need to be covered by a qualifying HDHP, not have other non-HDHP coverage, not be enrolled in Medicare, and not be claimed as a dependent. This synergy is key to understanding its value. Delving into the specifics of what makes a health plan HSA-eligible and confirming your personal circumstances is the crucial first step on this journey. For a comprehensive breakdown of the requirements and what it means to qualify, you'll want to Learn HSA fundamentals and eligibility.

The "Triple Tax Advantage" and How It Boosts Your Wallet

What truly makes an HSA shine is its unparalleled 'triple tax advantage,' a benefit rarely found in other savings vehicles. First, the money you contribute to your HSA is federally tax-deductible, lowering your taxable income. If you contribute through payroll deductions, you can even avoid FICA taxes (Medicare and Social Security), adding another layer of savings. Second, the funds in your HSA grow tax-free. This means any interest, dividends, or investment returns accumulate without being taxed year after year. Finally, and perhaps most impressively, withdrawals are entirely tax-free when used for qualified medical expenses. This trio of benefits creates a powerful engine for accumulating wealth, making your money work harder for you. This unique financial structure offers significant advantages over other savings methods, which is why understanding it fully is so important. Explore the full spectrum of these benefits and how they can impact your finances by reviewing HSA benefits and tax advantages.

What Qualifies as a Medical Expense? Beyond Doctor Visits

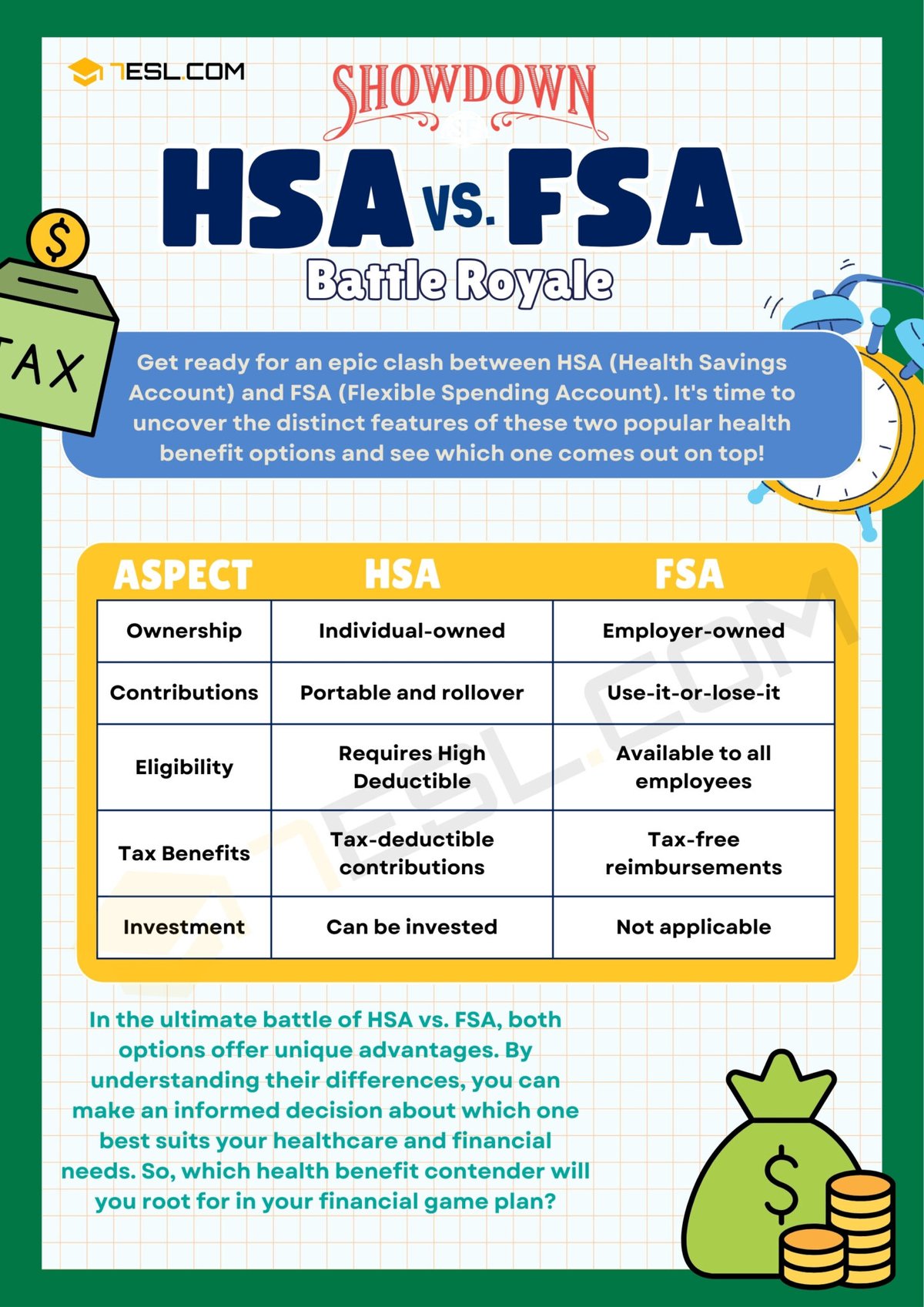

The range of qualified medical expenses for which you can use your HSA funds is surprisingly broad. It extends far beyond just doctor visits and hospital stays to include essentials like prescription medications, dental and vision care, mental health services, and even long-term care services. This flexibility ensures that your HSA can be a valuable resource for nearly every health-related cost you might incur, for yourself, your spouse, or even your dependents. Plus, unlike Flexible Spending Accounts (FSAs), your HSA funds roll over year after year – there’s no 'use-it-or-lose-it' pressure, allowing you to build a substantial medical savings fund for the future.

HSA as a Stealth Retirement Powerhouse

While its primary purpose is healthcare savings, the HSA's long-term potential as a retirement savings vehicle is where its true brilliance lies. Imagine having a dedicated, tax-free fund for your medical costs in retirement, a period when healthcare expenses typically rise significantly. After age 65, your HSA funds become incredibly flexible: you can withdraw money for any reason without the 20% tax penalty (though ordinary income tax will apply, similar to a traditional IRA). This flexibility means your HSA essentially transforms into an additional retirement account, without the burden of Required Minimum Distributions (RMDs) that apply to other retirement accounts. Many employers even contribute to employee HSAs, further supercharging your savings. To truly maximize this aspect, you need a clear strategy, and our guide on Master HSAs for retirement strategy can help you navigate these powerful opportunities.

Investing Your HSA for Exponential Growth

One of the most overlooked aspects of HSAs is their investment potential. Once you reach a certain cash balance, many HSA providers allow you to invest your funds in a range of options, from mutual funds to ETFs and stocks. This means your contributions and employer match aren't just sitting there; they can grow significantly over decades, compounding returns to create a formidable nest egg for future healthcare expenses or retirement income. However, only a fraction of HSA participants (around 21%) actually invest their assets, missing out on substantial long-term gains. Don't be one of them. Understanding how to select the right provider and investment options is key to harnessing this growth. Dive deeper into making your money work harder with your HSA by learning how to Invest your HSA for growth Grow.

HSA vs. The Alternatives: Why It Often Wins

When considering healthcare savings, you might encounter other options like FSAs or even just traditional savings accounts. It's crucial to understand how an HSA compares to these alternatives to fully appreciate its unique advantages. For instance, unlike FSAs, HSAs are portable and roll over year-to-year. The triple tax advantage also sets it apart from simply saving in a regular bank account. While an HSA requires an HDHP, its unparalleled tax benefits and investment potential often make it the superior choice for those who qualify and are looking for long-term financial security. If you're weighing your options and want to see a clear comparison, our detailed guide on HSA vs. Other Healthcare Savings will provide the clarity you need.

Understanding Contribution Limits and Taking Action

To truly maximize your HSA, you'll need to be aware of the annual contribution limits, which are set by the IRS. For 2025, individuals can contribute up to $4,300 and families up to $8,550. These limits are increasing slightly for 2026 to $4,400 for individuals and $8,750 for families. If you're age 55 or over, you can contribute an additional $1,000 as a catch-up contribution. Remember, these limits include contributions from both you and your employer. You can typically contribute for the prior tax year up until the federal tax filing deadline.

Ready to start? Here’s a quick roadmap:

- Confirm Eligibility: Make sure your current health plan is HSA-eligible.

- Choose a Provider: Look for providers with good investment options, low fees, and a low cash requirement to start investing. You can always change providers later.

- Fund & Invest: Set up contributions and, importantly, configure your investments within the HSA to foster long-term growth.

Navigating the Few Drawbacks and Penalties

While HSAs offer incredible benefits, it's also important to be aware of the potential downsides. The most significant is the penalty for using funds for non-qualified medical expenses before age 65: these withdrawals are subject to ordinary income taxes and a 20% penalty. After age 65, while withdrawals for non-medical reasons are penalty-free, they will still be taxed as ordinary income. Always ensure you're using your funds for qualified medical expenses or waiting until age 65 for maximum tax efficiency.

Is an HSA Worth It? A Confident Yes for Your Future

Ultimately, for individuals enrolled in a qualifying HDHP, an HSA is more than just 'worth it' – it's an indispensable tool for proactive financial planning. It’s a versatile account that empowers you to manage current healthcare costs with tax-free funds, build a substantial investment portfolio for future medical needs, and even create an additional, flexible income stream for retirement. By leveraging its triple tax advantage and long-term investment potential, an HSA can significantly enhance your financial well-being, providing peace of mind now and in the years to come.