In the complex landscape of personal finance and healthcare, navigating your options can feel like deciphering a secret code. One powerful tool that consistently surfaces in discussions about health savings and long-term financial planning is the Health Savings Account (HSA). But the real question isn't just what an HSA is, but critically, is an HSA right for you? Scenarios and considerations will decide if this particular account aligns with your unique financial picture and healthcare needs.

Understanding whether an HSA is a smart move for you involves more than just a quick glance at its features. It requires a thoughtful assessment of your health, spending habits, financial stability, and future goals. Let’s cut through the jargon and explore the practicalities of making an informed decision.

At a Glance: What You Need to Know About HSAs

- Tax Triple Play: Contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- HDHP Required: You must be enrolled in a High-Deductible Health Plan (HDHP) to be eligible.

- Funds Roll Over: Unlike some other accounts, HSA funds never expire and are yours to keep, even if you change jobs or retire.

- Invest for Growth: Many HSAs offer investment options, allowing your savings to grow like a retirement account.

- Retirement Backup: After age 65, you can withdraw funds for any purpose without penalty, though non-medical withdrawals are taxed as ordinary income.

- Higher Deductibles: The trade-off for HSA eligibility is often higher out-of-pocket costs with an HDHP before your insurance coverage kicks in.

Understanding the HSA Foundation: What It Is and Who Qualifies

Before we dive into scenarios, let's establish a clear understanding of what an HSA entails. At its core, a Health Savings Account is a tax-advantaged savings account specifically designed for individuals enrolled in a High-Deductible Health Plan (HDHP). Its purpose is twofold: to help you cover qualified medical expenses and to serve as a long-term savings and investment vehicle for future healthcare costs, including those in retirement.

Eligibility hinges on a few key criteria:

- HDHP Enrollment: You must be covered under a qualifying HDHP. For 2026, this means your plan's deductible must be at least $1,700 for an individual or $3,400 for family coverage. HDHPs typically come with lower monthly premiums.

- No Other Non-HDHP Coverage: You generally cannot be covered by another health plan that is not an HDHP (with some exceptions like dental, vision, or specific disease policies).

- No Medicare Enrollment: If you're enrolled in Medicare, you're not eligible to contribute to an HSA.

- Not a Tax Dependent: You cannot be claimed as a tax dependent on someone else's tax return.

- Self-Employed? No Problem: Self-employed individuals are eligible if they meet all the above criteria.

These rules ensure that HSAs are utilized as intended – by those who have chosen a specific type of health insurance plan designed to work alongside them.

The Power-Ups: Key Advantages of an HSA

An HSA isn't just another savings account; it's a strategically designed financial tool with several distinct advantages that can significantly boost your financial health.

The Triple Tax Advantage: A Rare Financial Gem

This is often the headline benefit and for good reason. Very few financial accounts offer this level of tax efficiency:

- Tax-Deductible Contributions: Money you contribute to your HSA is tax-deductible, reducing your taxable income in the year you contribute. This is true whether contributions come from payroll deductions or direct transfers.

- Tax-Free Growth: Your HSA funds grow tax-free. Any interest, dividends, or investment gains accumulate without being subject to taxes.

- Tax-Free Withdrawals: When you withdraw funds for qualified medical expenses, those withdrawals are completely tax-free. This trifecta makes the HSA incredibly powerful for healthcare savings.

Imagine saving for a large medical expense years down the line. With an HSA, every dollar you contribute reduces your current tax bill, grows without being taxed, and then can be used tax-free for that future need.

Long-Term Savings & Portability: It's Yours Forever

Unlike a Flexible Spending Account (FSA), which often has a "use it or lose it" rule, your HSA funds roll over indefinitely year after year. There's no deadline to spend the money. It's truly your account, owned by you, not your employer. This means if you change jobs, your HSA goes with you, completely portable.

This "no expiration" feature makes HSAs ideal for building a significant nest egg specifically for healthcare costs in retirement, where expenses can be substantial.

Investment Options: Putting Your Health Savings to Work

Many HSA providers offer investment options once your balance reaches a certain threshold. This is where the long-term growth potential truly kicks in. Instead of just sitting in a low-interest savings account, your funds can be invested in mutual funds, stocks, or other vehicles, much like a 401(k) or IRA. Over years, these investments can generate substantial returns, significantly increasing your available funds for future medical needs.

Flexible Usage: Beyond Just Doctor Visits

The definition of "qualified medical expenses" for an HSA is surprisingly broad. It includes:

- Doctor visits and specialist appointments

- Prescription medications

- Dental care (check-ups, fillings, braces)

- Vision care (eye exams, glasses, contact lenses, even LASIK)

- Mental health services

- Physical therapy

- Medical equipment and supplies

- Even over-the-counter medications (with a prescription or for certain items)

You can use these funds for yourself, your spouse, and any tax dependents, even if they aren't covered under your HDHP. This flexibility provides a comprehensive safety net for your family's health.

Retirement Supplement: A Back-Up IRA

Here's another powerful feature: After age 65, your HSA essentially transforms into an additional retirement account. You can withdraw funds for any reason—medical or non-medical—without penalty. Non-medical withdrawals will be taxed as ordinary income, similar to a traditional IRA or 401(k) withdrawal. This flexibility provides a valuable layer of financial security in retirement, whether you use it for healthcare or simply to supplement your income.

Generational Wealth Transfer: Passing on the Benefit

Should the account holder pass away, HSA funds can be transferred to a spouse's HSA without any tax consequences. This ensures the valuable benefits of the account can continue to support the surviving spouse's healthcare needs.

The Trade-Offs: Potential Drawbacks to Consider

While HSAs offer compelling benefits, they aren't without their considerations. Understanding these potential drawbacks is crucial for a balanced decision.

The HDHP Requirement: Higher Upfront Costs

The most significant trade-off is the mandatory enrollment in an HDHP. By definition, these plans have higher deductibles compared to traditional health insurance. This means you’ll pay more out-of-pocket before your insurance coverage begins to pick up the tab. For 2026, remember those deductibles start at $1,700 for individuals and $3,400 for families.

If you have frequent medical needs, manage a chronic condition with regular doctor visits, or rely on many prescriptions, you might find yourself consistently paying the full deductible amount before your insurance provides substantial coverage. This can put a strain on your immediate finances if you haven't built up your HSA or an emergency fund.

Investment Volatility: The Market's Swings

While investment options offer significant growth potential, they also come with market risk. The value of your investments can fluctuate, and there's always the potential for loss. If you plan to use your HSA funds in the near future for a significant medical expense, investing them aggressively might expose you to too much risk. A more conservative approach may be necessary depending on your timeline and risk tolerance.

Strict Withdrawal Rules: Keep it Qualified (Until 65)

Before age 65, withdrawing funds for non-qualified medical expenses comes with a hefty penalty: they're subject to your income tax plus a 20% penalty. This rule is in place to ensure the account is primarily used for its intended purpose. It reinforces the need to understand what constitutes a qualified medical expense and to keep meticulous records of your medical spending.

Contribution Limits: Maximize Your Savings

To maximize the benefits of your HSA, it’s essential to understand the annual contribution limits. For 2026, these limits are:

- Individual Coverage: You can contribute up to $4,400.

- Family Coverage: You can contribute up to $8,750.

For those aged 55 and older, there's an additional "catch-up" contribution allowing you to put in an extra $1,000 annually. This means an individual age 55+ with individual coverage could contribute $5,400, or $9,750 for family coverage if both spouses are 55+.

Contributions can be made in several ways: via payroll deductions (often pre-tax, directly reducing your gross income), direct bank transfers (which you can deduct on your tax return), or employer contributions (which also count towards the annual limit). Aiming to contribute consistently, and ideally up to the maximum, is key to leveraging the HSA's full potential.

Decision Time: Is an HSA Right For You? Scenarios & Considerations

Now for the core of the matter. Determining if an HSA is the right fit involves self-reflection and a look at your personal circumstances. Let's explore some common scenarios.

Scenario 1: The Healthy, Saver-Minded Individual

- You: Generally healthy, rarely visit the doctor beyond annual check-ups, and have minimal prescription needs. You're disciplined about saving and have a solid emergency fund. You understand market fluctuations and are comfortable investing for the long term.

- HSA Fit: Excellent. This is the ideal HSA candidate. You can leverage the lower HDHP premiums, contribute consistently to your HSA, and invest the funds for significant tax-free growth over time. You likely won't hit your deductible regularly, allowing your HSA balance to grow unspent. This strategy effectively turns your HSA into a powerful, additional retirement investment vehicle for future healthcare needs. Explore the value of an HSA to understand how these benefits accumulate over time.

Scenario 2: The Individual with Predictable, High Medical Costs

- You: Manage a chronic condition, require regular specialist visits, or take multiple expensive prescription medications. You anticipate reaching your deductible every year, or close to it.

- HSA Fit: Potentially Less Ideal, but Still Possible. For you, the higher HDHP deductible means you'll consistently pay a significant amount out-of-pocket before insurance kicks in. While an HSA helps by making those payments with tax-free dollars, the immediate financial strain might outweigh the long-term savings benefits.

- Consideration: Can you afford to pay the full deductible each year from your savings or your HSA? If so, the tax advantages on your contributions and withdrawals are still beneficial. If not, a traditional plan with lower deductibles and higher premiums might offer more predictable, manageable costs, even if it lacks the HSA's tax benefits.

Scenario 3: The Young Professional Just Starting Out

- You: Early in your career, generally healthy, but perhaps on a tighter budget with limited emergency savings. You're eager to save but need to balance immediate financial security with future goals.

- HSA Fit: Good, with Caveats. An HSA can be a fantastic tool to start building healthcare savings early, leveraging the power of compound interest. The lower HDHP premiums might also be attractive on a tighter budget.

- Consideration: The critical factor here is having access to an emergency fund (separate from your HSA) that can cover your HDHP deductible. If an unexpected medical event occurs and you haven't built up your HSA, you could face significant out-of-pocket costs without immediate funds. Prioritize building that emergency cushion first, or contribute enough to your HSA to cover the deductible.

Scenario 4: Nearing Retirement or Planning for Future Healthcare

- You: Age 50+, thinking seriously about retirement healthcare costs, or already retired and eligible for an HDHP. You have stable income or assets and are looking for tax-efficient ways to save.

- HSA Fit: Excellent. For pre-retirees, the HSA offers robust catch-up contributions (an extra $1,000 annually after age 55) and continues to grow tax-free. It's an unparalleled way to save for Medicare premiums, deductibles, co-pays, and other out-of-pocket costs in retirement. After 65, its flexibility as a penalty-free withdrawal account for non-medical expenses (albeit taxable) makes it a versatile retirement asset.

Scenario 5: The Individual with Limited Savings or High Medical Anxiety

- You: Have very limited emergency savings and the thought of a high deductible causes significant financial stress. You prefer the predictability of lower out-of-pocket costs, even if it means higher monthly premiums.

- HSA Fit: Poor. For you, the financial risk associated with an HDHP's high deductible might outweigh any potential tax benefits of an HSA. The peace of mind that comes with knowing your insurance will kick in sooner might be more valuable than the HSA's long-term growth. Focus on building an emergency fund first, then reassess your healthcare options.

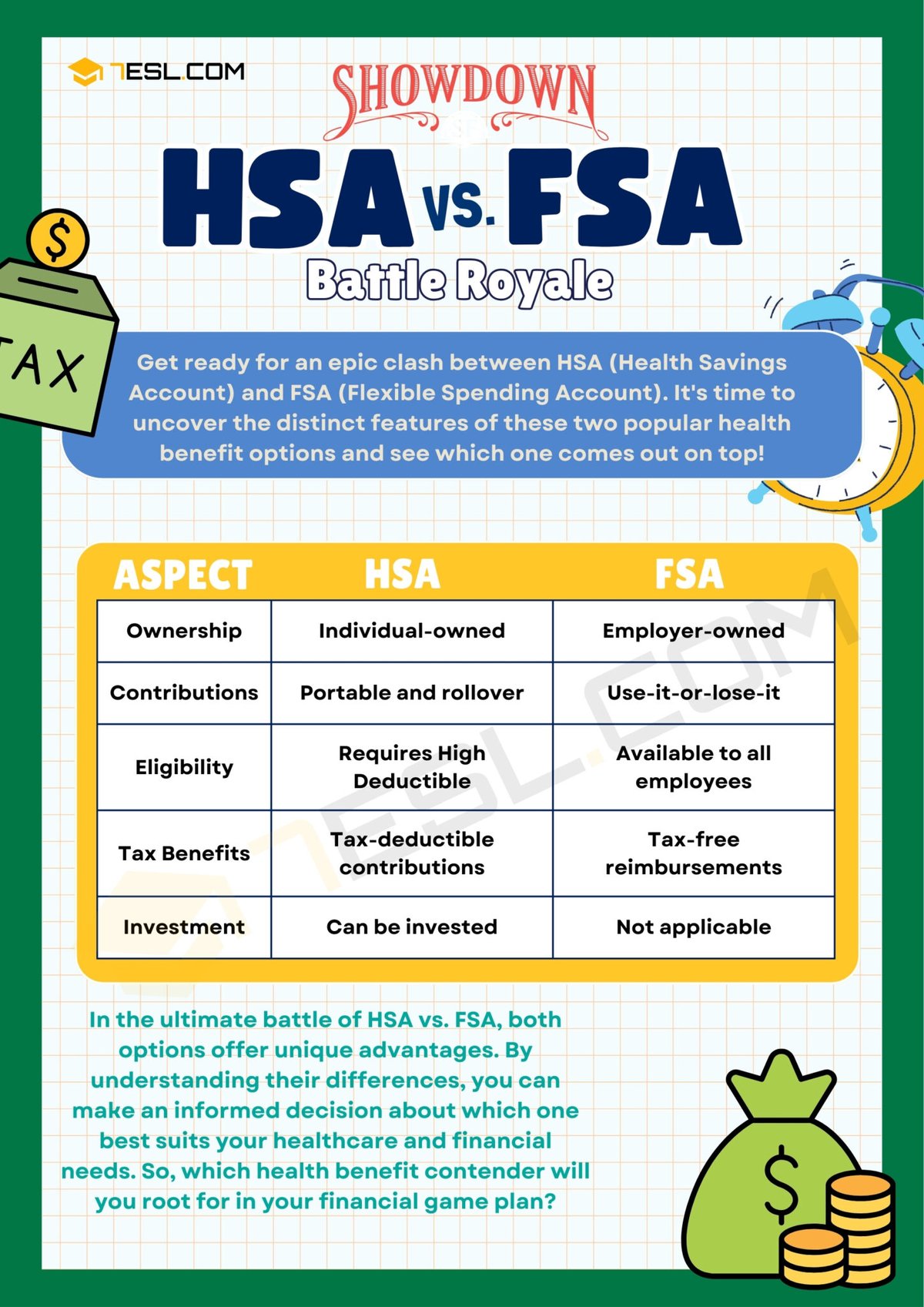

HSA vs. FSA: Knowing the Difference

It's common to confuse an HSA with a Flexible Spending Account (FSA), but they have critical distinctions:

| Feature | Health Savings Account (HSA) | Flexible Spending Account (FSA) |

|---|---|---|

| Eligibility | Must be enrolled in a High-Deductible Health Plan (HDHP) | Available through employer-sponsored plans |

| Ownership | Individual owns the account; portable | Employer owns the account; not portable |

| Rollover | Funds roll over indefinitely year to year (no "use it or lose it") | Funds typically forfeited if not used by deadline (small rollover allowed by some plans) |

| Investments | Many offer investment options for growth | Generally no investment options |

| Contributions | Tax-deductible | Pre-tax contributions (reduces taxable income) |

| Withdrawals | Tax-free for qualified medical expenses | Tax-free for qualified medical expenses |

| Retirement | Can be used for non-medical expenses (taxable) after age 65 | Cannot be used after employment ends or for retirement |

| The key takeaway: An HSA is a long-term, individual-owned savings and investment vehicle, while an FSA is a short-term, employer-sponsored account for current-year medical expenses. |

Navigating the Nuances: Practical Guidance

Making an HSA work for you involves more than just opening an account. Here’s some practical advice:

- Know Your HDHP: Understand your specific plan's deductible, out-of-pocket maximum, and what services are covered pre-deductible (many HDHPs cover preventive care at 100% even before the deductible is met).

- Fund Your Deductible First: If possible, try to save at least enough in your HSA (or a separate emergency fund) to cover your annual deductible. This provides a crucial buffer.

- Automate Contributions: Set up automatic payroll deductions or monthly transfers to consistently fund your HSA. This "set it and forget it" approach ensures steady growth.

- Invest Early and Smart: If your HSA provider offers investment options, consider allocating a portion of your funds to investments, especially if you have a comfortable emergency fund and don't anticipate needing the money soon. The earlier you start, the more time your money has to grow.

- Keep Records: Maintain detailed records of your qualified medical expenses. While you don't typically submit receipts when you use your HSA card, you might need them if audited by the IRS to prove withdrawals were for qualified expenses.

- Don't Reimburse Immediately: A clever strategy is to pay for current medical expenses out-of-pocket (if you can afford it) and save your receipts. Let your HSA funds grow through investments. You can then reimburse yourself, tax-free, for those past qualified expenses at any point in the future. This allows your money to grow even longer.

Common Questions & Misconceptions

"What if I switch to a non-HDHP plan?"

You can no longer contribute to your HSA, but you still own the account and can use the existing funds for qualified medical expenses at any time, penalty-free and tax-free. The funds remain yours.

"Can my employer contribute to my HSA?"

Yes, many employers contribute to employee HSAs, which is a fantastic benefit. These contributions also count toward your annual limit.

"Is an HSA only for healthy people?"

Not necessarily. While it's particularly advantageous for healthy individuals who can maximize long-term savings, those with predictable medical expenses can still benefit from paying those costs with tax-free funds from their HSA, provided they can comfortably cover the deductible. The key is affordability and planning.

"What if I accidentally withdraw for a non-qualified expense?"

Before age 65, non-qualified withdrawals are subject to income tax and a 20% penalty. After age 65, they are only subject to income tax, like a traditional IRA.

Making Your Decision: A Path Forward

Determining if an HSA is right for you requires a personalized assessment of your healthcare usage, income stability, and savings priorities. It's a powerful tool for those who can manage the higher deductibles of an HDHP and are focused on building long-term financial security for healthcare costs.

Consider these final steps:

- Review Your Health Needs: Honestly assess your and your family's typical medical spending. Do you foresee significant costs, or are you generally low-utilization?

- Evaluate Your Financial Cushion: Do you have an emergency fund separate from your HSA that can comfortably cover your HDHP deductible?

- Understand Your Employer's Offerings: What HDHP options are available through your employer, and do they offer any HSA contributions?

- Crunch the Numbers: Compare the total estimated annual costs (premiums + potential out-of-pocket) of an HDHP with an HSA versus a traditional plan. Factor in the tax savings from HSA contributions.

- Seek Expert Advice: Don't hesitate to consult with a trusted fiduciary financial advisor or tax advisor. They can provide personalized insights tailored to your unique financial situation and help you weigh the pros and cons more thoroughly.

By carefully considering these scenarios and factors, you can make an informed decision about whether an HSA will be a valuable asset in your financial toolkit, helping you secure both your health and your wealth for years to come.